Understand your insurance needs

Start by understanding your insurance needs and priorities. your health financial obligations; Assess factors such as personal belongings and future goals. This assessment will help you determine the types and levels of insurance coverage you need to adequately protect yourself and your property.

Prioritize health insurance:

Health insurance is a basic requirement and ensures coverage for medical expenses and access to quality healthcare. employer-sponsored plans; Explore options such as coverage through individual plans or parents’ policies. Premiums when choosing a health insurance plan; Deductible Consider factors such as network coverage and prescription drug coverage.

Consider life insurance:

Life insurance is especially important for millennials who have dependents or significant financial obligations. It provides financial security for loved ones in the event of an untimely demise. Consider term life insurance, which offers affordable coverage over a specified period, or permanent life insurance for lifetime protection and potential cash value accumulation.

Protect your income with disability insurance:

Disability insurance is often overlooked, but it’s essential for protecting your income if you’re unable to work due to illness or injury. It provides a portion of your income during a disability, ensuring financial stability and the ability to meet your financial obligations. Review your employer-provided coverage and consider additional individual disability insurance if needed.

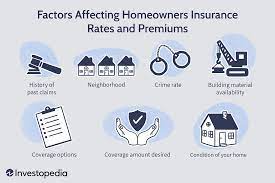

Renters or Homeowners Insurance:

Whether you rent or own a home, it’s important to protect your personal belongings and liability. Renters insurance offers broader coverage for homeowners, while homeowners insurance offers broader coverage for homeowners. Assess your needs and loss; stealing Or select an appropriate policy to protect against liability claims.

Auto insurance

If you own a car, auto insurance is a legal requirement and important for financial protection. liability coverage; collision coverage; comprehensive coverage; And consider coverage options such as uninsured/underinsured motorist coverage. Compare quotes from insurance providers to find the best coverage at an affordable price.

Evaluate your employer’s benefits:

Take advantage of insurance benefits provided by your employer. employer-sponsored health insurance; life insurance Review and understand additional benefits such as disability insurance and dental or vision coverage. Extend these benefits to supplement your comprehensive insurance coverage.

To understand policy details:

Be sure to read and understand the details of your insurance policies. coverage limitations; Deductible Be aware of exclusions and additional riders or endorsements. A clear understanding of policy terms will help you make informed decisions. This will help you avoid surprises and make sure your coverage meets your needs.

Check and update your policies regularly:

Insurance requirements change over time, so it’s important to review your policies periodically. getting married having children or evaluate changes in your circumstances, such as the purchase of significant assets. Update your policies accordingly to ensure adequate coverage and adjust your coverage as your needs change.

Get professional advice:

Seek advice from insurance professionals or financial advisors when it comes to insurance decisions or need guidance. They will assess your needs; We can explain policy details and provide personalized recommendations based on your unique circumstances.